Trump Announces Reciprocal Tariffs of Up to 50%

TEXT : Jordan Largnick

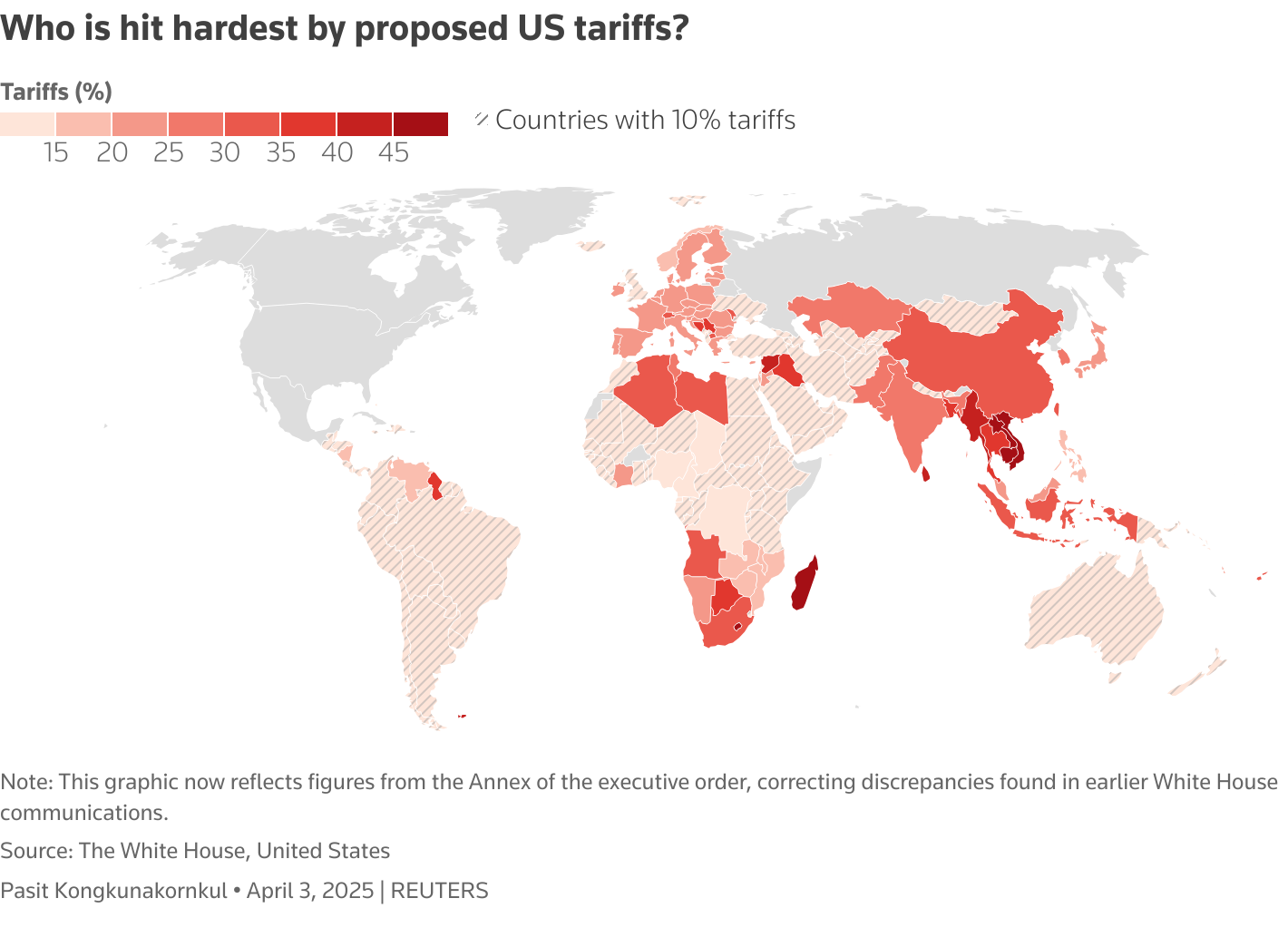

On the 2nd, U.S. President Donald Trump unveiled a new plan for tariffs on all imported products to the United States. This is seen as a major shift in the international trade order established after World War II. The plan calls for a basic tariff of at least 10% on all imports. Trump had proposed this measure during last year’s presidential election. According to U.S. government documents, the basic tariff will apply to over 100 countries, with approximately 60 of them facing additional tariffs. Trump referred to this as a "reciprocal" tariff. Products from countries the government considers to be "the worst offenders," such as the European Union (EU) and China, will face higher rates.

For Chinese products, an additional 34% tariff will be applied on top of the existing 20%, while the EU will face a 20% tariff, Japan 24%, Taiwan 32%, and India 26%. On the other hand, the United Kingdom will only face the basic 10% tariff.

Trump made the announcement at the White House’s Rose Garden, with the national flag in the background. He argued that other countries had been engaging in unfair trade practices, such as high tariffs and other trade barriers, exploiting the U.S. He emphasized the necessity of this measure as a form of retaliation. He also stated, “This is a declaration of economic independence,” and added, “Today, we are standing up for American workers and finally putting America first. This will likely be one of the most important days in American history.”

According to the U.S. government, the basic 10% tariff will take effect on the 5th, and the additional tariffs on specific countries will go into effect on the 9th.

The Trump administration has already instructed an increase in tariffs on imports from China, foreign cars, steel, and aluminum. Additionally, 25% tariffs are imposed on some products from Mexico and Canada. The U.S. government has explained that nothing will change for its closest trading partners, Mexico and Canada, under this new tariff plan.

The highest tariffs will apply to small countries, with Lesotho in southern Africa facing 50%, Vietnam 46%, and Cambodia 49%. Since the first term of the Trump administration, there has been a surge in corporate investments in Vietnam and Cambodia as companies have shifted their supply chains from China.

On the other hand, only the basic 10% tariff will be applied to countries such as the United Kingdom, Singapore, Brazil, Australia, New Zealand, Turkey, Colombia, Argentina, El Salvador, the United Arab Emirates, and Saudi Arabia.

Analysts predict that the intensification of the trade war under Trump will likely lead to inflation and slower economic growth in the U.S. Some countries may even experience recessions.

Kenneth Rogoff, former chief economist of the International Monetary Fund (IMF), told the BBC, "He has just dropped a nuclear bomb on the international trading system." Olu Sonola, head of U.S. economic research at Fitch Ratings, predicted that the U.S. tariff rate will return to levels not seen since 1910. “This will not only change the U.S. economy, but will also reshape the global economy,” he stated. “Many countries are likely to fall into recession.”

Gustavo Flores-Macías, a professor of government and public policy at Cornell University, pointed out that "inflation is likely to become a reality soon." He said that Trump’s announcement marks the "collapse" of the international trade system that the U.S. helped establish after World War II.

On the same day, Trump signed an order to end the exemption for Chinese packages, which will expire in May. This move is expected to harm Chinese companies like SHEIN and Temu, which are rivals to Amazon. He also announced that a 25% tariff on imported foreign cars, which was revealed last week, would take effect on the 3rd.

Following the announcement, which Trump called "Liberation Day," U.S. stock markets saw a sharp decline in after-hours trading. Apple, which has a high dependency on China and Taiwan, fell by more than 7%. Amazon dropped over 6%, Walmart fell more than 4%, and Nike saw a decline of more than 6%.